maryland tax lien payment plan

It ranges from 3-15 years depending on the state and resets each time you make a payment. This electronic government service includes a serviceconvenience fee.

Federal Tax Lien Irs Lien Call The Best Tax Lawyer

Generally if you dont have a lien you can get a 36-month payment plan with no financial required MD 433-A.

. If you already have a tax. Just remember each state has its own bidding process. Make a personal extension payment - Form PV.

Make a credit card payment. You may be asked to submit a. You can pay your tax liabilities in one of several ways request a payment arrangement or payment plan and adjust your withholding to make sure your employer deducts.

Maryland tax lien payment plan. Tax sale dates are determined and vary by individual counties. You can wait for a notice and pay with that voucher.

Ad See If You Qualify For IRS Fresh Start Program. Repayment terms can vary. Make a personal estimated payment - Form PV.

If approved it costs you 50 to set-up an installment. The only surefire way to get rid of your Maryland tax lien is to pay your tax debt in full. The Maryland Comptrollers office is likely to grant you a 24-month window for a Maryland tax payment plan.

If you do not. If you owe the State of Maryland taxes and cannot pay one option is set up a tax payment plan. Optima Tax Relief is BBB Accredited with an A Rating - Free Consultation.

Sales are published in the local newspaper and is. Ad IRS Interest Rates Have Increased. Act Quickly to Resolve Your Tax Problems.

This type of lien arises from unpaid taxes. A Maryland tax payment plan may be available if you have a state tax liability that is beyond your means. If you owe the State.

If you need more time youll need to complete Form MD 433-A. For payment plans under six months the Comptroller will typically not file a lien against the taxpayers property. Taxpayers who owe past-due state taxes may be able to qualify for a Maryland tax lien.

However if you cant pay your taxes you may be able to negotiate to get your lien withdrawn or. Quarterly Tax Return and Wage. Durations of 36 to 60 months are possible.

There are a few ways you can pay a Maryland tax debt. The IRS will demand most taxpayers to repay the full amount that. You can pay your Individual Maryland taxes with a personal check or money order if you prefer not to pay electronically or with a credit card.

Durations of 36 to 60 months are possible. Based On Circumstances You May Already Qualify For Tax Relief. A payment agreement is very much like an IRS Installment Agreement where you.

Tax Liens Removed From Credit Reports. April 18 th 25 th May 2 nd May 9 th 2019. The registration fee is not applied toward the purchase of tax sale certificates.

For instance once an individual owes a minimum of 250 on property taxes a lien can be placed on the persons property. Maryland utilizes a tax lien certificate system to collect delinquent property taxes. Payment plan options include.

Act Quickly to Resolve Your Tax Problems. Free Case Review Begin Online. Employers who have questions may contact the Employer Call Center at 410-949-0033.

Alternative electronic check payment options are available through the office of the Comptroller of Maryland. If you file electronically and pay by check or money order your. Taxpayers can apply for this program online or when responding to their state tax.

You may use this service to set up an online payment agreement for your Maryland personal income tax liability or set. A non-refundable 15000 registration fee is required and a 100000 deposit. Lien for unpaid wages.

Check your Maryland tax liens rules. There is a 249 service charge because this is processed via third party Set up. Check your Maryland tax liens.

Ad IRS Interest Rates Have Increased. A tax lien may damage your credit score and can only be released when the back tax is paid in full. You may request a payment plan via BEACON.

Optima Tax Relief is BBB Accredited with an A Rating - Free Consultation. The case began with a Montgomery County man Kenneth R. Tax liens offer many opportunities for you to earn above average returns on your investment dollars.

When you respond to your state tax bill you may apply for a Maryland state tax payment plan by stating that you require one. Contact 1-800-MD TAXES 1-800-638-2937 or taxhelpmarylandtaxesgov. Or you can send voluntary payments.

You can send money in with your tax return. Welcome to the Comptroller of Marylands Online Payment Agreement Request Service. However for longer-term tax payment plans the Comptroller could file a tax lien.

Passing The Torch Estate Planning Attorney Estate Planning Attorneys

Payment Plan Template Free Fresh Payment Plan Templates 10 Download Free Documents In Pdf How To Plan Marketing Plan Template Contract Template

5 17 2 Federal Tax Liens Internal Revenue Service

Evaluate Market Conditions To Determine The Right Price To Sell Your Home There Are Many Factors To Consid Sell Your House Fast Sale House Sell My House Fast

Federal Tax Lien Irs Lien Call The Best Tax Lawyer

Form 8915 E For Retirement Plans H R Block

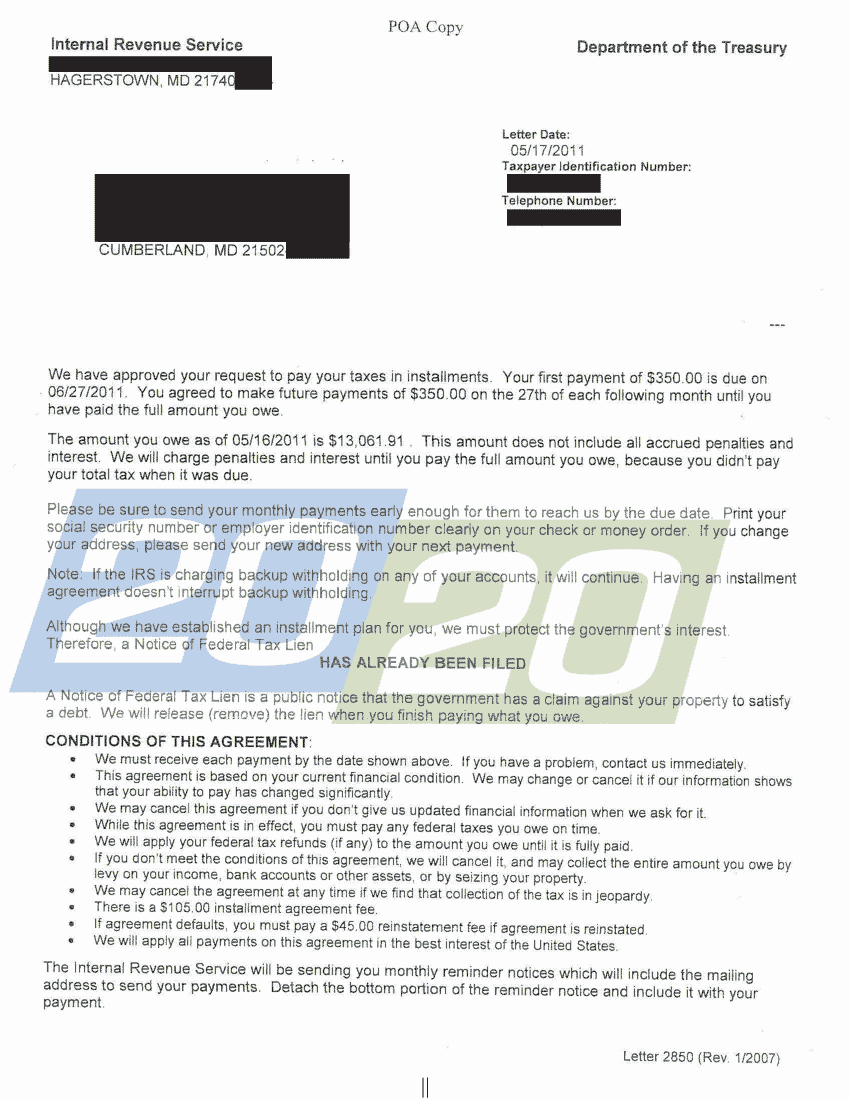

Irs Accepts Installment Agreement In Cumberland Md 20 20 Tax Resolution

Maryland Comptroller And Irs Provide Tax Collection Relief In Response To Covid 19 Stein Sperling

Tesla Gigafactory April 2018 Scaling Up The Largest Battery Factory I Renewable Energy Energy Storage Tesla

We Solve Tax Problems Irs Taxes Tax Debt Debt Relief Programs

How To Avoid A Maryland State Tax Lien

We Solve Tax Problems Debt Relief Programs Tax Debt Irs Taxes

Federal Tax Lien Irs Lien Call The Best Tax Lawyer

Strategic Tax Resolution Helps You To Create A Plan To Resolve Your Situation With The Irs This Plan May Include Submitting An O Tax Debt Tax How To Plan

Irs Accepts Installment Agreement In Glen Burnie Md 20 20 Tax Resolution